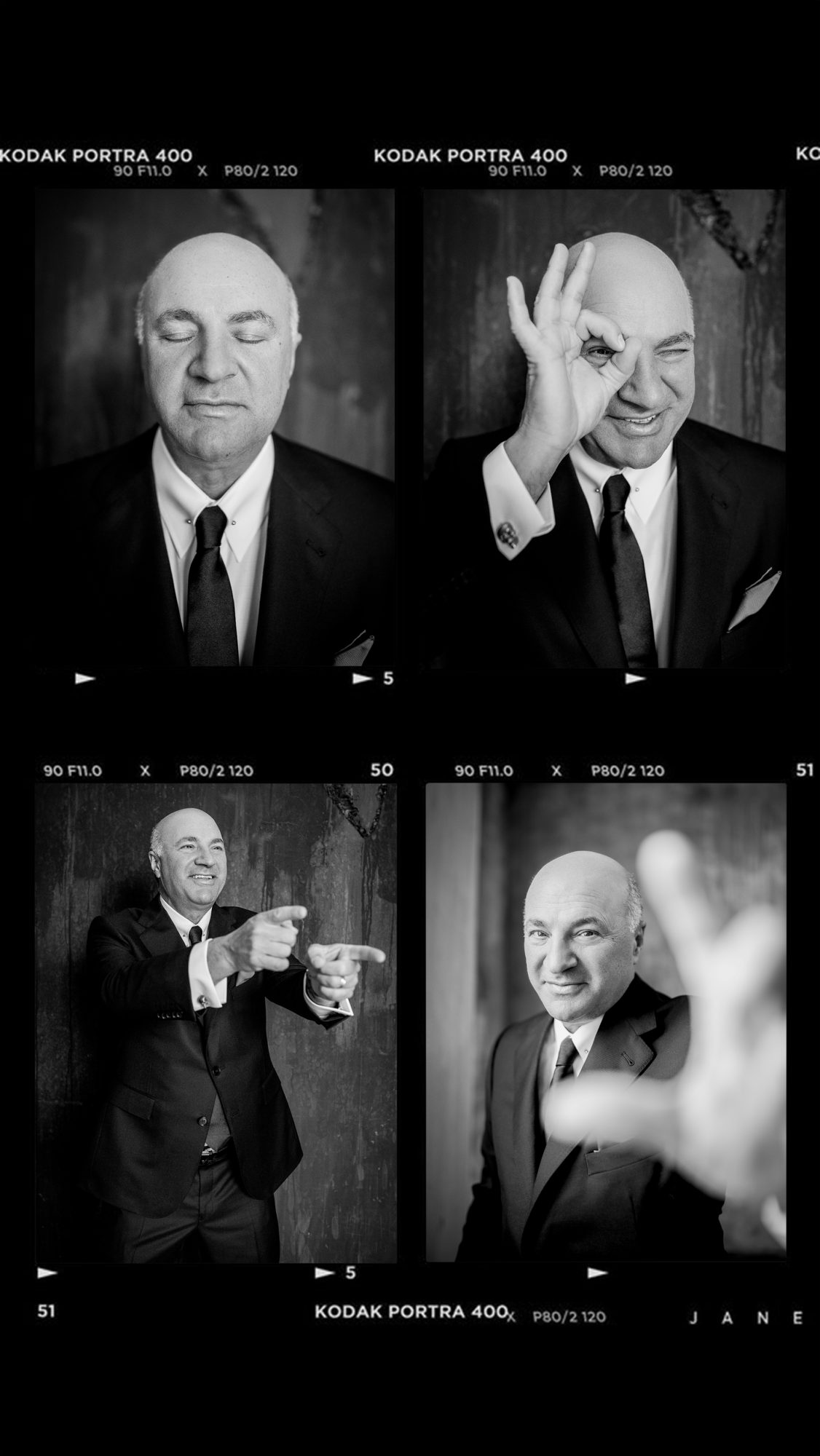

Kevin O’Leary is a successful businessman, investor, author (‘Cold Hard Truth On Men, Women and Money‘), and TV personality who has appeared on various television shows including ‘Dragon’s Den’ and its American equivalent ‘Shark Tank‘ where he got his nickname ‘Mr. Wonderful’ from. He has co-founded and managed different companies such as O’Leary Funds and SoftKey, and his recent project – O’Leary Ventures, a private early-stage venture capital investment company.

“To have a broad diversification of different investments is very important”, says Kevin. His affection, he admits, can be won by those companies that make him the most money. Even though on both shows, ‘Shark Tank’ and ‘Dragon’s Den’ Kevin makes deals for hundreds of thousands of dollars, he says that he is a very conservative investor outside of those shows. Heavily influenced by his mother, who always saved 10% of her income and invested her money properly, Kevin prefers the smart approach to his investments: “Most of my money is invested in large companies that are profitable and pay dividends. I have a global portfolio, that includes European and Asian companies, and the way I look at it is if you put your money into an investment it should be a company that is making money and paying you dividends. After all, when you think about the stock market over fifty years, 70% of returns came from dividends and not capital appreciation. So the idea that you’re going to make money when the stock goes up is pure speculation. There are many periods of time when a stock goes flat but if the company is profitable and paying you a dividend then you’re making money, no matter what the stock price is. So I tend to favour companies that are basically profitable, large, global in nature and paying me dividends per quarter. People forget that markets tend to go up over a long period of time, so if you are getting paid in dividend, you’re getting a compound growth.”

Believing in Charlie Munger’s philosophy of sufficient cash flow, Kevin O’Leary says that many of the pitches on ‘Dragon’s Den’ and ‘Shark Tank’ are unattractive for an investor like him due to the absence of free cash flow. After 17 years of listening to various pitches, Kevin determined that there are certain things that can make for a successful pitch on the show: “Firstly, people have to be able to articulate the opportunity in 90 seconds or less. Then, they should explain why they are the right people who can take the idea and turn it into a business – what is it about; do they work in a family business or have they been trained; are they accredited; do they work for competitor; have they tried it before – this is what I like to hear. And lastly, they should be able to explain the business model and know their numbers, as it matters a lot. But the most important thing is that they are able to explain their thing in a very short period of time.” But even despite someone’s ability to deliver a strong pitch, some ideas just seem too ridiculous and crazy. Seeing pretty much everything throughout these years, Kevin believes that “crazy ideas aren’t always that crazy if they can be translated into a business opportunity”.

Having worked with both Canadians and Americans, Kevin believes that there are talented people in both countries, but the US has more opportunities and better resources, “In Canada, we only have a few sectors to our economy: agriculture, a strong resource base and banking however, we don’t really have a defence or a pharmaceutical sector. So we basically have three sectors while in the US they have eleven. This is why even though the shows ‘Dragons’ Den’ and ‘Shark Tank’ are identical and are owned by Sony Pictures Television, you’re going to get more diversity and deals on ‘Shark Tank’ versus ‘Dragon’s Den’. Robert Herjavec, a fellow cast member on ‘Shark Tank’ is also a Canadian like Kevin. “The same great entrepreneurs exist in Canada as there are in the US, and I would even argue that in some sectors like music and entertainment, Canada leads. If you go to LA or NY, 50% of the people producing or recording or making television are Canadians,” says Kevin, “I work on ‘Shark Tank’ in LA and I would say 30% of people working on set are Canadians, including the people who are Sharks.”

But despite all the talent Canada has, it has been challenged when it comes to attracting capital over the past few years, Kevin says, “The direct investment is falling off by nearly 52% in Canada, nobody seems to want to invest here anymore because nothing gets done and so most capital goes into the US market. Because the US dollar has been stronger than the Canadian dollar and also there is more product there, their market is more liquid.” All this may also negatively affect new businesses opening up in Canada unless the business owners have calculated all the risks and returns properly suggests Kevin, “When you start your own business the number one thing you should focus on is the revenue. Most people have very optimistic projections on what they are going to do with the revenue and they find out later that it’s almost impossible to forecast. They have these expenditures they can’t control and if they spend too much and don’t bring enough revenue, they go bankrupt. That happens to 8 out of 10 companies in North America and 80% fail within the first three years just because they are unable to forecast revenue while their expenses are too high.” However, these costs are not the only ones people need to pay attention to. The lion’s share of money usually goes towards marketing and advertising costs when it’s a new business. “Another reason why starting a new business can be difficult is the cost of acquiring a customer. Nobody will know about a new business until the company starts spending money on advertising their product or service. That’s called the customer acquisition cost and if it’s too high then the company is going to go bankrupt. So my advice to people starting their own business is always the same: be extremely conservative with how much money you spend. Underspend dramatically because no one will fund your losses after 3 years.”

Talking about the venture capital business, O’Leary believes that in the US the market is healthier, not to mention ten times bigger than the Canadian one. In Kevin’s opinion, having a bad political situation does not stop Canada from having a fantastic talent, “Montreal is very famous for graphic design and software, and a lot of digital artists are there. Toronto and Vancouver have huge production facilities now because a Canadian dollar is cheaper than the US dollar, so half the television I shoot for American TV is done in those cities. It’s not that Canada doesn’t have a good advantage, it just has some bad politics”. Opposing the current political system, Kevin O’Leary engaged in a run for office in 2017 but didn’t get enough support in Quebec: “I tried politics but I got really whacked in Quebec because I don’t speak French. I think there will come the time when you can become a Prime Minister in Canada without speaking the second language, but that time is not now. I was trying something a little different but I don’t think I could be technically proficient enough to debate in French – so that’s where I had a problem”. With a considerable amount on his plate right now, Kevin is not planning to get back into politics again any time soon. Instead, he’s focusing on his ventures, including Kevin O’Leary Fine Wines.

Having been a wine connoisseur from an early age and figuring out there is very little good wine at accessible price points, Kevin decided to start his own wine company. He learned from his Swiss stepfather the differences between Burgundy and Bordeaux, New World and Old World, how to differentiate one wine from another and how to blend them: “I started collecting wine and trading wine futures which became a business for me. Then I realized that most of the wine that is consumed in North America, more than 97% is sold under $14 a bottle and most of it is really bad. And I thought that I could probably do a much better job bringing much higher quality to market at that price. So when I started the company, I’ve sold 150k cases of different wine in a year all across North America. I like that business a lot, and I think it’s wonderful when you can make money and enjoy what you’re doing at the same time.”

Another passion for Kevin is collecting guitars and watches: “I’ve been collecting guitars for years, I have a large collection of pretty much every kind”. Specializing in Fenders and Telecasters, Kevin also owns some Gibsons, signed by Les Paul. “It’s an expensive hobby”, says Kevin, but it’s exciting, especially when he gets to record with his co-star from ‘Shark Tank’ Daymond John. As for Kevin’s impressive watch collection, it brought him the highest appreciation out of all his assets, “My watch collection could beat the stock market last year. Every watch I bought is up in value between 37% and 60%. So for example when I bought the watch I’m wearing {Rolex Submariner Hulk}, it was about $12k, and right now it’s valued between $18k and $22k USD. Men have very few options for jewelry: they can wear rings, cufflinks, and watches. And the only other accessory we can have is a pen. So I have a massive pen collection as well. The pen I have with me is a Mont Blanc, they only make about 1,700 of this pen. I enjoy collecting pens, cufflinks, and watches not just because they are fun to collect but because they are valuable investments.”